- Healthcare 150

- Posts

- LLCP Acquires Synergy, $2.4T Elderly Care Boom, Medical Tourism Trends

LLCP Acquires Synergy, $2.4T Elderly Care Boom, Medical Tourism Trends

This week, we explore the burgeoning trillion-dollars elderly care market, where rising global life expectancy drives the demand for innovative and sustainable solutions in this rapidly growing industry.

Happy hump day, !

This week we explore the burgeoning trillion-dollars elderly care market, where rising global life expectancy drives the demand for innovative and sustainable solutions in this rapidly growing industry.

The healthtech sector in the US and Europe remains resilient despite a decline in transaction values and deal activity from 2021 peaks, with 2024 showing steady investor interest and a recalibrated pace of growth.

Global surgery cost disparities create opportunities for investors in medical tourism and healthcare innovations, with cost-effective hubs like India and Thailand driving affordable, high-quality care.

— Healthcare 150 Team

📚 Data Dive

Elderly Care’s $2.4 Trillion Opportunity

The global elderly care market is not just growing—it’s compounding at a sleek 7.77% CAGR, projected to hit $2.4 trillion by 2032. The driver? A demographic shift as steady as an actuary’s hand: aging populations worldwide. Countries like Japan (where 28% are 65+), the U.S. (healthcare-spending king), and Germany (EU’s eldercare front-runner) highlight this seismic trend.

Tech innovation is turning wrinkles into growth lines. Think AI care bots in Tokyo or telemedicine boomlets in Seattle. Meanwhile, governments are propping up the industry with subsidies, insurance expansions, and funding for workforce training. Still, challenges loom: eldercare costs pinch, caregivers are scarce, and some cultures balk at institutional care.

For investors, developed nations offer ripe returns, but emerging markets (China and India) hint at scale-friendly potential. The bottom line? Elderly care is poised to be the compound interest play of the decade.

Want to learn more?

📈 Trend of the Week

Robotic Health’s Steady Rise

The global surgical robotics market is on a growth trajectory, projected to reach $36.37 billion by 2031, up from $9.27 billion in 2023. That’s a whopping CAGR of 18.3%, driven by breakthroughs like Siemens Healthineers' Photon Counting CT and Vitestro's autonomous blood-drawing devices. These innovations promise more precise diagnostics and safer, more reliable procedures.

But adoption isn’t universal. High costs, regulatory hurdles, and infrastructure gaps in healthcare systems remain significant barriers. While developed markets push the boundaries of robotic health, broader accessibility depends on investments and policy shifts.

📊 Market Movers

⚕️ HealthTech Corner

HealthTech VC deals rebounding

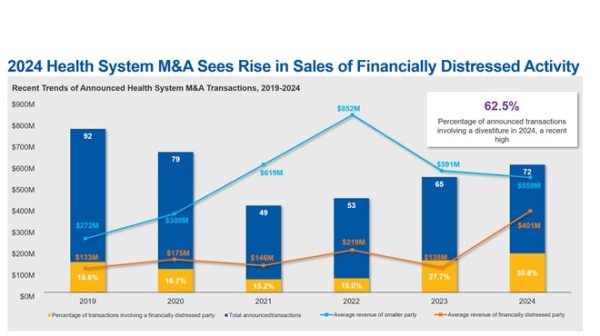

The healthtech sector in the US and Europe continues to demonstrate significant investor interest, though deal activity and transaction values have moderated from the highs of 2021.

In 2021, healthtech deals reached a peak, with 1,293 transactions amounting to an impressive $38.1 billion in transaction value. However, by 2023, these numbers had declined to 1,155 deals and $15.6 billion, reflecting broader economic headwinds and investor caution. In 2024, despite being only halfway through the year, the sector recorded 728 deals worth $12.2 billion, signaling sustained activity, albeit at a recalibrated pace. While the decline in transaction value reflects a shift toward more measured investment strategies, the steady deal flow underscores the resilience of healthtech as a critical area of focus for venture capital.

For investors, this evolving landscape presents both challenges and opportunities. The consistent deal volume highlights ongoing innovation in areas like digital health, medical devices, and AI-powered healthcare solutions, which remain attractive amid an aging population and rising healthcare demands. At the same time, the decline in deal value suggests a sharper focus on smaller, more strategic investments, with heightened scrutiny of valuations and growth potential. Healthtech remains a sector of strategic importance, with investors well-positioned to capitalize on the sector's long-term growth trajectory by targeting disruptive technologies and scalable solutions that address systemic inefficiencies in healthcare delivery and access.

🤝 Deal of the Week

LLCP acquires SYNERY HomeCare

Levine Leichtman Capital Partners (LLCP) has announced its acquisition of SYNERGY HomeCare, a leading in-home care franchisor, in partnership with the company’s management team.

Operating across 550 territories in 42 states, SYNERGY provides a wide range of non-medical in-home services, including personal care, companion care, memory care, and specialized care for individuals with disabilities or chronic health conditions. With its robust franchise model and rapid territory growth, SYNERGY has positioned itself as a leader in the in-home care market, a sector benefiting from significant demographic tailwinds. LLCP's extensive experience in franchising and in-home care, including prior investments in Senior Helpers and Caring Brands, makes it a strategic partner to support SYNERGY’s ambitious growth plans.

This acquisition marks a pivotal chapter for SYNERGY as it focuses on accelerating market expansion, optimizing franchisee operations, and enhancing service offerings under the continued leadership of CEO Charlie Young.

With LLCP’s resources and expertise, SYNERGY aims to capitalize on the rising demand for in-home care services driven by aging demographics and increasing preference for at-home solutions.

As LLCP’s eighth platform investment from its Lower Middle Market Fund III and 17th franchising investment overall, the deal underscores the firm’s commitment to backing scalable, high-growth opportunities in healthcare and franchising. With plans to open new markets and expand access to professional in-home care, SYNERGY is well-positioned to lead the in-home care industry through its next phase of growth.

Love Healthcare150? Receive the Same Weekly Newsletter For the Private Equity Market!

PE150 (same publishers of Gift Card Trends) delivers proprietary insights, market trends, and actionable tools for Private Equity & M&A professionals—in just one 5 minute weekly email. Subscribe now

📍 Regional Focus

Regional focus: Cost-effectiveness of procedures

The global disparity in the cost of surgeries underscores significant opportunities for health investors and stakeholders in regions offering high-quality, cost-effective care.

For example, a hip replacement in the U.S. costs an average of $50,000, compared to $14,120 in Korea, $12,000 in Singapore, and just $7,000 in India. Similarly, heart bypass surgeries, which can cost a staggering $144,000 in the U.S., are available for $5,200 in India and $15,121 in Thailand.

These differences are not merely economic—they reflect a growing trend in medical tourism, as patients seek affordable options without compromising on quality. Markets such as India, Thailand, and Singapore are establishing themselves as hubs for cost-efficient medical services, driven by skilled healthcare professionals, state-of-the-art infrastructure, and competitive pricing.

For investors, these regional differences present a dual opportunity. On one hand, they create a compelling case for investment in medical tourism infrastructure and healthtech innovations that can scale accessibility in these regions. On the other, they emphasize the value of partnerships with healthcare providers in cost-effective markets to cater to international patients. Markets like India, where an angioplasty costs $3,300 compared to $57,000 in the U.S., are particularly attractive for high-demand procedures. By capitalizing on these trends, investors can help bridge the gap between cost and care while addressing a global need for affordable healthcare solutions. As healthcare systems worldwide grapple with rising costs, the focus on these cost-effective regions is more relevant than ever.

📰 Interesting Articles

"Opportunities don't happen. You create them"

Chris Grosser